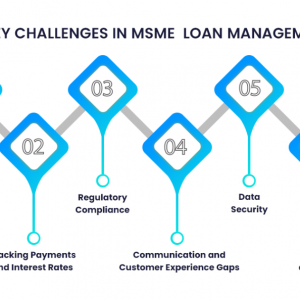

In the ever-evolving world of financial services, effective loan management is crucial to sustaining growth and profitability. CredAcc’s Loan Management System offers a state-of-the-art solution that addresses the unique challenges faced by banks and NBFCs in managing MSME loans. This platform is built to enhance operational efficiency, ensure timely repayments, and improve overall loan recovery.

At the heart of this solution is a commitment to reducing manual intervention. The Loan Management System automates critical processes such as loan servicing, repayment tracking, and post-disbursal collections. By integrating with existing banking platforms through its API-first design, the system facilitates seamless data flow and real-time monitoring. This not only boosts operational efficiency but also enables proactive management of loan portfolios.

Real-time monitoring is a game-changer for financial institutions. With continuous updates on loan performance and automated alerts, banks can quickly identify and address potential issues before they escalate. The system’s automated notifications remind borrowers of upcoming or overdue payments, significantly reducing default rates and ensuring a smoother cash flow.

Another significant advantage of the Loan Management System is its customizable reporting functionality. Lenders can generate tailored reports that provide insights into repayment trends, delinquency rates, and overall portfolio health. This data is critical for making informed decisions and refining lending strategies. With customizable dashboards, financial institutions gain a comprehensive view of their operations, enabling them to adjust policies and strategies swiftly.

Flexibility is a key benefit of CredAcc’s solution. The Loan Management System can be configured to suit the specific needs of different lenders. Whether it’s setting up unique repayment structures or integrating additional security features, the system is designed to evolve with your business. This adaptability ensures that as market demands change, your loan management processes remain efficient and relevant.

Customer experience is also enhanced through the use of this advanced system. Borrowers benefit from transparent communication, timely reminders, and a seamless payment process. This level of service not only improves customer satisfaction but also builds trust and loyalty towards your institution.

CredAcc’s Loan Management System is an essential tool for any financial institution aiming to streamline its loan operations and improve recovery rates. By automating routine tasks, enabling real-time monitoring, and offering customizable features, this system provides a comprehensive solution that drives efficiency and profitability. Embrace the future of loan management and transform your lending operations today.