Supply Chain Finance plays a vital role in unlocking working capital for businesses and supporting end-to-end supply chain resilience. For banks and NBFCs offering SCF lending, staying competitive means providing fast, flexible, and compliant financing solutions. This is where CredAcc’s no-code Loan Origination and Loan Management platform makes a significant impact.

Accelerate Loan Workflows with No-Code Automation

Speed is essential in supply chain finance. Businesses depend on timely financing to keep operations moving smoothly. CredAcc allows financial institutions to design and deploy SCF workflows using a drag-and-drop configurator. This low-code environment removes the dependency on IT teams and accelerates time-to-market for new loan products.

From onboarding to underwriting and disbursement, every step in the loan lifecycle can be automated, significantly reducing loan turnaround times and improving customer satisfaction.

ERP Integration for Enhanced Risk Visibility

CredAcc’s platform connects directly with enterprise resource planning (ERP) systems to access real-time financial data. For lenders, this provides unprecedented visibility into the borrower’s financial health and transaction history within the supply chain.

By integrating with ERP systems, lenders can improve credit risk evaluation and monitor loan performance dynamically. Real-time monitoring ensures that potential risks are identified early, allowing institutions to take proactive measures and maintain portfolio quality.

Streamlined Compliance and Audit Processes

Regulatory compliance in Supply Chain Finance can be complex. Whether it's adhering to anti-money laundering (AML) rules or ensuring Know Your Customer (KYC) protocols, compliance is non-negotiable. CredAcc’s platform includes built-in compliance tools that streamline audits and reduce regulatory risk.

These tools provide automated document management, verification workflows, and audit trails—all designed to meet local and international compliance standards. This not only protects the institution but also builds trust with stakeholders.

Drive Operational Efficiency and Scale SCF Lending

CredAcc empowers banks and NBFCs to scale SCF lending profitably. By removing manual bottlenecks and optimizing workflows, financial institutions can increase loan volumes without increasing operational overhead.

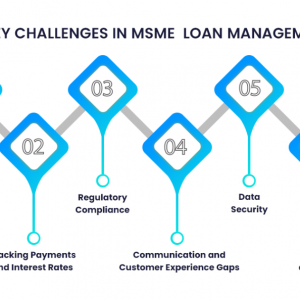

This is particularly important in the MSME segment, where fast access to working capital can define business survival. With CredAcc, lenders can efficiently serve small and mid-sized enterprises through personalized and compliant SCF solutions.

See the Platform in Action – Book a Demo

CredAcc is redefining how financial institutions deliver Supply Chain Finance. With tools that combine no-code configurability, ERP integration, and regulatory compliance, the platform is a comprehensive solution for modern lending.

If you’re ready to improve efficiency, reduce costs, and stay ahead in the SCF market, book a demo today. Discover how CredAcc can help you automate loan origination and management from start to finish.