Introduction

The global mechanized irrigation systems market is witnessing robust growth as agriculture modernizes and water scarcity becomes a central concern. The use of advanced irrigation technologies is seen as a crucial strategy to meet the rising food demand and manage limited water resources efficiently. From drip irrigation to center pivots, mechanized solutions are reshaping farming by improving yields, reducing manual labor, and optimizing water usage across diverse terrains.

Market Overview

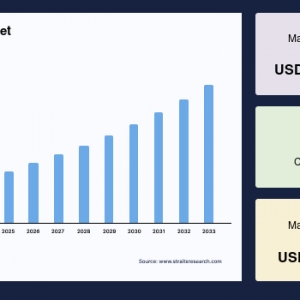

The global Mechanized Irrigation Systems Market Size was valued at USD 1.27 billion in 2024 and is projected to reach from USD 1.44 billion in 2025 to USD 2.85 billion by 2033, growing at a CAGR of 13.40% during the forecast period (2025-2033).

North America leads as the largest regional market due to its climatic challenges and advanced agricultural practices, while Asia-Pacific stands out as the fastest-growing region, bolstered by government support and rapid adoption of modern technologies.

Key Growth Drivers

The surge in mechanized irrigation adoption is driven by several interrelated factors:

-

Water Scarcity and Efficiency: With agriculture accounting for nearly 70% of global water withdrawals, efficient water management is critical. Mechanized solutions save water, minimize evaporation losses, and make irrigation more precise, addressing the growing competition for water among agricultural, domestic, and industrial users.

-

Modern Farming Practices: Farmers are turning to advanced irrigation to maximize productivity while using less water. Modern mechanized systems allow for larger-scale food production, supporting efforts to feed a growing global population projected to double food production needs by 2050.

-

Government Incentives: Subsidies, training initiatives, and demonstration projects are motivating farmers—especially in regions like India—to invest in mechanized irrigation. These measures are key to overcoming adoption barriers, particularly among small-scale farmers.

Market Segmentation

The mechanized irrigation market can be segmented in multiple ways, with each category showing distinct dynamics:

-

By System Type: Drip irrigation holds the largest share due to its superior water use efficiency and low operational costs. It delivers water directly to plant roots, reducing disease risk and labor, and allowing other farming operations while irrigating. Center pivot systems are also gaining ground for their uniform application and energy efficiency.

-

By Crop Type: Fruits and vegetables form the largest segment, as these crops benefit most from precise, scheduled irrigation. There is also strong adoption in pulses, oilseeds, and staple agricultural crops, especially in developing countries aiming to boost yields and meet export targets.

-

By Application: Apart from traditional agriculture, lawns and gardens in urban environments are increasingly utilizing mechanized systems, notably in regions like Europe with extensive sports pitches and green spaces.

Regional Insights

-

North America: Climatic shifts, especially drought and water shortages, are accelerating adoption. Notably, technological support and government subsidies have made advanced irrigation accessible to more farms, with significant uptake in states like California and Texas.

-

Asia-Pacific: Government programs and large-scale initiatives are transforming the irrigation landscape, particularly in India and China. The promotion of drip and sprinkler systems aims to address drought and maximize limited water supplies.

-

Europe: Rising focus on green urban landscapes, sports infrastructure, and water management is driving demand for advanced systems in non-agricultural settings as well.

Challenges and Opportunities

Despite its advantages, the mechanized irrigation market faces notable obstacles:

-

High Initial Costs: The expense of installing and maintaining modern systems can be prohibitive, especially for small-scale farmers with limited land and tight budgets.

-

Adoption Barriers: Many regions still depend on manual irrigation or rain-fed agriculture due to tradition, lack of awareness, or fragmented landholdings.

-

Crop Suitability: Not all crops justify mechanized irrigation investment—a pattern more pronounced where farm incomes are lower or less predictable.

Nonetheless, ongoing innovations—such as IoT-enabled control, remote sensing, and improved energy efficiency—are expanding the addressable market. Public-private partnerships and tailored subsidies have the potential to lower the entry threshold for smaller farmers and niche applications.

Conclusion

Mechanized irrigation systems are set to play a foundational role in sustainable agriculture and water management. Their growing adoption reflects a global pivot toward precision, efficiency, and climate resilience. While cost and awareness barriers persist, concerted efforts by governments, industry stakeholders, and technology innovators continue to shape a market with strong long-term prospects. As population and food demands rise and water resources come under even greater pressure, mechanized irrigation will remain at the forefront of agricultural transformation and food security.