Introduction

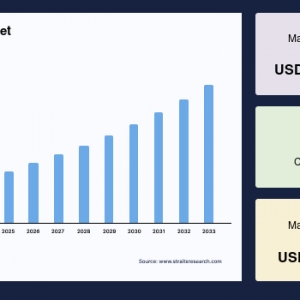

The global silicone surfactant market size was valued at USD 2.49 billion in 2024 and is estimated to grow from USD 2.66 billion in 2025 to reach USD 4.23 billion by 2033, growing at a CAGR of 5.1% during the forecast period (2025-2033). The growth of the market is attributed to growing personal care industry and increasing demand for polyurethane foams.

Market Drivers

Several factors are driving this upward trajectory. The personal care sector plays a pivotal role, with silicone surfactants being key ingredients in products such as shampoos, conditioners, lotions, cosmetics, and UV-safe skincare items. Rising consumer interest in anti-aging and beauty care products, alongside growing disposable incomes, is fostering demand for high-quality personal care formulations containing silicone surfactants.

Additionally, the polyurethane foam sector significantly contributes to market growth. Silicone surfactants serve as essential foam leveling agents in the production of polyurethane foams used for insulation, cushioning, and structural applications, all of which benefit from the foam’s improved quality and performance. Urbanization, construction sector growth, and regulatory focus on energy efficiency intensify the demand for polyurethane foams and, by extension, silicone surfactants.

The textile industry also represents an important growth avenue. Silicone surfactants enhance fabric processing by improving softness, durability, color retention, and dye dispersion attributes highly valued in emerging economies with growing textile production.

Market Applications and Benefits

Silicone surfactants are characterized by their distinctive chemical structure, including a hydrophobic polydimethylsiloxane backbone combined with organosilicon polar groups, which confer stability and hydrophobicity. This configuration ensures excellent surface tension reduction, emulsification, foam stabilization, and compatibility with various formulations.

The market is segmented by functional applications such as emulsifiers, wetting agents, foaming agents, defoaming agents, and dispersants. Emulsifiers dominate due to their ability to stabilize oil-in-water emulsions, which are crucial in personal care, agricultural pesticides, and industrial coatings.

Wetting agents find vital use in agriculture for pesticide efficacy enhancement, textile dyeing for improved fabric treatment, and industrial coatings ensuring uniform application and adhesion. Silicone surfactants also perform well as defoamers and dispersants across multiple sectors, further underpinning their versatility.

Regional Insights

The Asia-Pacific region dominates the silicone surfactant market, driven by rapid industrialization, a booming personal care market, and an extensive manufacturing base. Key countries like China, India, Japan, and South Korea are significant contributors, supported by government initiatives encouraging domestic chemical production. The rising environmental consciousness is catalyzing innovations in green silicone surfactants, especially in Japan and South Korea.

North America is forecasted to be the fastest-growing market region, growing at a CAGR of approximately 4.95% through 2033. This growth is supported by technical innovations, strong R&D focus, and an advanced regulatory environment that favors high-performance and durable silicone surfactant formulations. North American manufacturers lead in specialty surfactants for personal care, cosmetics, aerospace, automotive coatings, lubricants, and agricultural adjuvants.

Europe holds the position of the second-largest regional market, with steady growth attributed to expanding end-use industries such as cosmetics and personal care, automotive, and construction.

Challenges and Restraints

Despite the promising outlook, the market faces challenges. The demand for oil-soluble silicone surfactants remains lower compared to water-soluble variants due to the former's limited absorption and efficacy in some applications such as personal care products. Regulatory pressures, raw material price volatility, environmental concerns, and competition from alternative surfactant technologies also act as potential restraints.

Moreover, the limited compatibility of some silicone surfactants and performance restrictions in specific applications may inhibit widespread adoption, necessitating continued innovation and product development.

Future Outlook and Opportunities

The global silicone surfactant market offers extensive opportunities, notably through innovations in eco-friendly and biodegradable formulations responding to environmental regulations and consumer preference shifts. The continued expansion of usage in personal care, precision agriculture as adjuvants enhancing agrochemical efficiency, and new industrial uses like paints, coatings, and polyurethane foam manufacturing underpin future market growth.

The convergence of rising industrialization, growing disposable incomes in emerging economies, and heightened consumer awareness about product quality is expected to sustain the robust demand for silicone surfactants. Investments in technology and new product development that emphasize multifunctionality and sustainability will be critical success factors for market players.