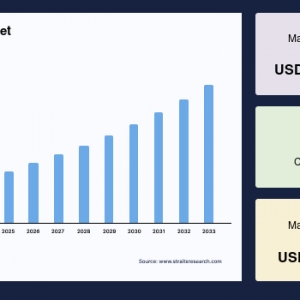

The global bio-alcohol market size was valued at USD 11.29 billion in 2024 and is projected to grow from USD 12.55 billion in 2025 to reach USD 29.95 billion by 2033, growing at a CAGR of 6.5% during the forecast period (2025–2033).

Bio-alcohols, including bio-ethanol, bio-methanol, bio-butanol, and bio-propanol, are regarded as eco-friendly alternatives to fossil fuels, commonly produced by fermenting organic raw materials like starches, sugars, and cellulose using microorganisms and enzymes.

Market Drivers and Environmental Impact

The surge in demand for bio-alcohols is largely fueled by the escalating scarcity and fluctuating prices of crude oil and other non-renewable energy sources. These biofuels offer significant environmental benefits, such as reducing net greenhouse gas emissions by over 37%, owing to the carbon dioxide absorbed by crops during photosynthesis, which offsets emissions produced during combustion. Governments worldwide are increasingly supporting renewable energy initiatives, establishing regulations and incentives that promote the use of bio-alcohol fuels to address climate change and reduce dependency on fossil fuels.

Moreover, the expanding global population and growing vehicular demand in emerging economies contribute to the rising need for sustainable energy resources. Bio-alcohols are also gaining traction beyond transportation, finding applications in agrochemicals, chemical intermediates, and industrial sectors that emphasize sustainability.

Production and Feedstock Dynamics

Bio-alcohol can be classified into first-generation and second-generation types. The first-generation bio-alcohols are derived from food crops like sugarcane, starch-rich plants, and vegetables, which can pose food security concerns. Conversely, second-generation bio-alcohols are produced from non-edible biomass such as agricultural residues, wood, and stems, offering a more sustainable alternative without competing with human food resources.

Feedstock availability and cost significantly influence bio-alcohol production economics, accounting for more than 75% of production expenses. The long-term manufacture of bio-alcohol necessitates large amounts of biomass, with technological advancements enabling more efficient use of cellulosic biomass. However, challenges remain such as the need for arable land, the carbon footprint associated with bioethanol production, and potential impacts on food prices when crops are diverted for fuel production.

Regional Market Insights

The Asia-Pacific region emerges as the largest market for bio-alcohol, fueled by rapid industrialization, infrastructure development, and an expanding automotive sector in countries like China, India, and Indonesia. The growing middle-class population in these regions drives demand for high-performance biofuels and renewable energy products.

North America is the fastest-growing market, supported by stringent government regulations and financial incentives that encourage renewable energy production. The adoption of biofuels in countries such as the United States and Canada is also bolstered by increasing crude oil prices and efforts to reduce carbon emissions.

Europe remains a major consumer of bio-alcohols, with countries like Germany advancing biofuel use driven by strict environmental regulations. The automotive sector in Europe focuses on improving fuel efficiency through the adoption of bio-based fuels.

In South America, growing industrialization and the need for renewable energy sources are expected to drive bio-ethanol demand, further expanding the market.

Product Segments and Applications

Among various bio-alcohols, bioethanol holds the largest market share due to its high octane value, renewability, and comparatively low emissions. It is widely used as a fuel additive and an alternative to gasoline in transportation, reducing reliance on fossil fuels.

Biomethanol, valued for its high octane rating and application in fuel cells, offers advantages such as excellent performance and low emissions. Biobutanol, which closely resembles gasoline in properties, is gaining popularity as it can be used in existing gasoline engines without modifications.

Besides fuel applications, bio-alcohols are also employed in medical treatments, infrastructure materials, and manufacturing of adhesives, insulating foams, and coatings. Their biodegradability positions them as sustainable alternatives in several industrial processes.

Challenges and Future Outlook

While the bio-alcohol market presents substantial growth opportunities, it faces challenges including feedstock availability, price volatility, and concerns about land use and food security. Innovations to increase yields from non-food feedstocks and improved fermentation technologies will be key to overcoming these hurdles.

The drive towards sustainability, coupled with government support and technological advancements, is expected to expand the use of bio-alcohols across various sectors. The transportation industry will remain a major end-user, but diversification into chemical intermediates, pharmaceuticals, and infrastructure applications will support continued market development.

As the world shifts towards cleaner energy alternatives, bio-alcohols are set to play an increasingly critical role in reducing carbon footprints and supporting the global transition to renewable energy. The forecast period through 2033 is poised to witness steady market expansion fueled by rising awareness of environmental benefits and concerted policy efforts.